Lean Legal Team or Solo GC? Check Out the New Guide to Contract Management Just for You

For lean legal teams and solo general counsel, navigating the contract management system procurement process can be daunting.

For lean legal teams and solo general counsel, navigating the contract management system procurement process can be daunting.

John will be focused on ensuring Pramata customers maximize their use of our platform, cementing their partnership with our company and our value as the radically simple contract management solution.

Simplifying and getting control of manual contract management can be overwhelming. Legal teams big and small are spread thin between reviewing and drafting contracts, helping sales teams with renewals, new contract requests, and all the ad-hoc questions thrown at you daily.

Layoffs are an unfortunate reality in the business world. Throughout 2022, a perfect storm of factors — from inflation to supply chain disruptions to global conflicts — have pushed businesses to reduce operating expenses, often resulting in dramatic reductions in headcount.

Legal teams large and small struggle with one universal issue: your reputation within your own company. It doesn’t matter how hard you work or how many hours you slave away serving the needs of every internal department, legal is often seen as an adversary, not an ally. What if there was a way you could turn that reputation around and ensure your legal team is a valued partner of the business?

Picture this: You’re the new GC at a company without a large supporting legal team. You walk in the door, into a role in which you’re expected to manage vendor contracts, customer contracts, employee contracts, and contracts governing business relationships and partnerships.

In part three of our blog series covering Forrester Consulting’s study commissioned on behalf of Pramata, we dig into the opportunities available to contract management teams that realize the full strategic value of their CLM solution and are able to maximize their contract management technology investments.

Legal Week is fast approaching (it’s March 20-23, 2023 in case you don’t already have it on your calendar) – and I’m excited to be presenting a CLE-eligible emerging technology session along with my friend, and “Contracts Queen,” Roma Khan of Crush Contracts.

If your current contract management process (either manual or an existing CLM) has you or your staff at your breaking point, look for a solution designed with small legal teams in mind.

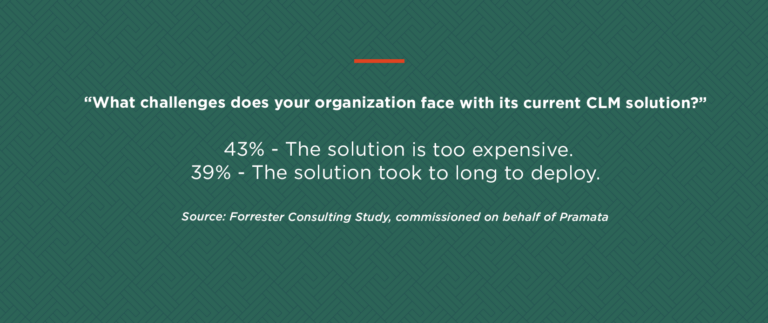

At a time when companies are required to do more with less, contract management technology is becoming increasingly more expensive and taking an alarming amount of time to deploy while failing to deliver on key business goals.

Pramata Founder and CEO Praful Saklani shares his insight on the contract management landscape and why it’s time our industry focuses on the things that matter most.

A contract management system should make your job easier, not harder. But when you’re shopping for a solution it’s easy to get distracted by fancy features and focus on the wrong things.

The CLM landscape has hit an inflection point as contract management solutions have become cost prohibitive, taking too long to deploy and then failing to deliver once they are up and running.

Service level agreements are a necessary part of business, and if you’re working as general counsel, chances are you encounter them on a regular basis.

As an in-house legal professional, ultimately your role is to support the business and all its employees by providing legal advice on contracts. But, when you or your department struggle to meet the demands of internal teams, legal can quickly become a bottleneck to the rest of the business.

When considering legal technology, it’s important to understand what AI’s good at and what it’s not. Find out where humans (with law degrees!) should fit in to maximize the success of your contract management solution.

As new GC, you’re expected to hit the ground running. Find out how access to Pramata’s contract management solution can give you a huge boost.

Faster Contracts = Faster Revenue—and it all begins with data. Learn 3 slam dunk approaches to improve deal acceleration.

Legal ops professionals want to know they bridge the gap between what Legal Tech can do and what legal teams must do to make it work.

Contract AI is not a “magic button“ that solves all your problems, but it can deliver significant benefits as long as you have a sound resourcing plan.

Executive partnerships will make your contract management project more likely to be successful. Here’s a recipe for success.

Get exclusive event invites, peer best practices and the latest industry news right in your inbox!

1.415.963.3544

1 Sansome Street, Suite 3500

San Francisco, CA 94104

USA

info@pramata.com